Referential and Reviewed International Scientific-Analytical Journal of Ivane Javakhishvili Tbilisi State University, Faculty of Economics and Business

Geographical Distribution of the Tourism Value Chain of Georgia by the Example of Accommodations

The value chain of the tourism industry is remarkably diverse and includes many different sectors of the economy, be it agriculture, food industry, services, construction sector, etc. Accordingly, the development of tourism in the country, in the wake of meeting the needs of tourists can lead to the development of a number of other sectors and, in this way, have a positive impact on the country’s economy as a whole.

However, the situation is different for import-dependent countries like Georgia. The value chain of tourism significantly deviates from the country's borders and, accordingly, there is an outflow of tourism revenues from the country. In order to make the most of the positive effects of tourism, it is necessary to optimize the spatial value chain and integrate the local product as much as possible.

Before creating optimal spatial models, it is necessary to conduct an in-depth study and analysis of the current situation. Within the scope of this research, we have narrowed down the tourism value chain to the level of the accommodation value chain.

This paper explores and analyzes the geographic diversification of the Georgian tourism value chain through a comparative analysis of the export-import balance of the group of main products included in the value chain of accommodations in Georgia.

The article is a part of the dissertation research, the methodology of which is the transdisciplinary approach. As part of the research, in-depth interviews and structured interviews with representatives of accommodations have already been conducted; in-depth interviews with industry experts; Secondary statistical data were collected and analyzed.

The data obtained as a result of the research were processed mainly using Excel and MAXQDA.

This research [PHDF-21-4839] has been supported by Shota Rustaveli National Science Foundation of Georgia (SRNSFG).

Keywords: Tourism value chain, export-import balance, tourism in import-dependent countries, Georgia.

JEL Codes: L80, L83, L89

Introduction

In the process of meeting the needs of tourists, the tourism industry increases the demand for diverse products and services in the market, therefore, it stimulates the development of different sectors of the economy, which should ultimately contribute to the strengthening of the country's whole economy. Considering this, tourism has the potential to positively affect the country's socioeconomic condition.

Tourism value chain analysis provides an opportunity to evaluate how well the country is utilizing the potential of the tourism industry. The tourism business has a complex value chain that includes accommodations, restaurants, attractions, other service industries, agriculture, catering, handicrafts, creative industries, distribution, etc. (Vanriel 2013, 2-3).

For tourism to generate maximum economic benefits, the tourism value chain needs to be integrated into local economies and local production needs to be promoted. This will spread the benefits of tourism to the local population and keep income in the country (Baidoo et al. 2022, 5). Well-planned, implemented and managed tourism industry contributes to the overall economic development of a destination by creating and strengthening linkages between different sectors of the economy (Wondirad et al. 2021, 2). Taking this approach, the tourism industry can fully realize its potential and strengthen other economic sectors.

However, the situation is different in import-dependent countries. For countries whose economies are undiversified and highly dependent on tourism, and whose tourism industry is overly dependent on imported products, the problem of financial leakage arises (Baidoo et al 2022, 2). Georgia also falls within the category of countries whose imports are much more than exports and where imports make up a vast majority of the basket of goods (Papava 2018).

While the tourism industry in Georgia is one of the leading sectors of the economy, and at the same time, tourism has the potential to be a driver for the development of other fields of the economy, it is interesting what fact Georgia is actually facing. Does it use tourism opportunities positively or vice versa?

In order to make it possible to rationally plan the development of the tourism sector, to develop optimal models and to use the tourism potential as much as possible, it is necessary to study and analyze the current situation at the initial stage. Therefore, the aim of this paper is to reveal and analyze the geographical diversification of the tourism value chain of Georgia and present potential opportunities. This goal required the following actions to be accomplished: A) Identifying the main product groups involved in the tourism value chain; B) revealing Georgian products’ share of the tourism value chain; C) studying the geography of the tourism value chain through analyzing the trade balance of the main product groups.

Literature review

The indirect impact of tourism on the economy and its value chain is a relatively less studied topic than the popular ones in this area (Salukvadze, Gugushvili 2019, 173-174). However, both in the world and in Georgia, there are researchers who write about the above-mentioned topics that are important for this article. All of them agreed that the tourism industry creates direct and indirect demand in other economic fields. Some of them focus on strategies that ensure greater involvement of local products in the tourism value chain, while others point to challenges, especially in developing and import-dependent countries.

Wesley Vanriel assumes that countries need to strengthen and invest in other sectors of the local economy such as agriculture, manufacturing, technologies and so on in order to reap the maximum benefits from the tourism industry. Providing local products to tourists can only be achieved by strengthening the local economy. The author also points out the challenges of developing countries' economies in terms of the competitiveness of local products compared to imported ones. He mentioned that developing countries tend to be dependent on imports. Therefore, he believes that the priority of the state should be investing in other sectors of the economy and strengthening the links between tourism and the local economy (Vanriel 2013, 4-5).

For import-dependent countries, the evaluation of the Georgian academician, Vladimir Papava, should also be taken into account. According to him, tourists who come to the country consume the same basket of goods, which means that along with the growth of the number of tourists, the dependence on imported products also increases. In the end, it turns out that the country’s tourism industry does not develop other sectors of the country's economy but those of the importing countries (Papava 2018).

Professor Ioseb Khelashvili highlights the main challenges of the tourism industry in Georgia: an overdependence on several segments (tourist-generator countries); a low multiplier effect; and a high level of dependence on imports. The ability of the local economy to meet tourism-generated demands from various sectors of the economy determines the high level of the multiplier effect. And those requirements that cannot be satisfied by the local economy are satisfied by imported products. Accordingly, the revenue received through tourism leaves the country and we are facing a low multiplier effect and financial leakages (Khelashvili 2018, 505-507).

Gvantsa Salukvadze whose main research focus is on the tourism supply chain in high-mountain Georgia, with her colleagues provides several interesting articles about the linkages of tourism and tourism-driven economic activities. She agrees that the contribution of tourism to the overall economy cannot be assessed if we do not assess its relationship with other sectors of the economy (Salukvadze, Backhaus 2020, 30). According to her research, in Georgia’s highland destinations, among local products, agricultural products are more integrated into the tourism value chain than others (Salukvadze, Gugushvili 2019, 185).

João Garcia Rodrigues and Sebastián Villasante emphasize tourism-driven opportunities for the local economy and small-scale businesses. As specified by the authors, tourists can pay higher prices for products than local consumers, so they can buy the most expensive ones (Rodrigues, Villasante 2016, 38). Therefore, the country can increase the production of expensive seafood, agriproducts or products for which the state has the appropriate resources (Rodrigues, Villasante 2016, 34).

Other researchers indicate culinary and agritourism's role as a driver of regional economic development and socio-cultural revitalization. For tourists for whom culture is the main motivation for travel, culinary tourism provides an opportunity to share local culture through local cuisine. Consuming local products creates an authentic experience for tourists (Wondirad et al. 2021, 3). However, they also point to the obstacles that prevent local products from being integrated into the tourism value chain. They identify specific challenges: low productivity of local agriculture, difficulty in ensuring quality and stable product supply, insufficient entrepreneurial and innovative efforts, outdated technologies for growing, producing, storing and selling products and lack of qualified human resources (Wondirad et al. 2021, 8).

In order to present the topic in every way, it is important to discuss an interesting paper (“Importing to Feed International Tourists: Growth Implications for Islands across the Globe”) that emphasizes not tourism-driven possibilities for the local economy, but the correlation between tourism and import growth. According to that paper the demand for basic goods and services from tourism industry representatives and international tourists due to increased tourism automatically increases the demand for imports to supplement or in some cases replace local products (Baidoo et al. 2022, 2). The authors focus on several reasons why restaurants and accommodations prefer to buy imported products: A) Some tourists prefer to use a product they are familiar with, it is safer in terms of quality. B) The local product does not meet high standards and is also unstable in supply. C) Sometimes the imported product is cheaper. D) Local producers lack information, do not know the requirements of restaurants and accommodations about product standards and are also unstable in supply (Baidoo et al. 2022, 4).

The challenges listed by foreign authors in the last two paragraphs are related to Georgia.

Methodology

Considering the complexity of the tourism value chain, it was decided to use a transdisciplinary theoretical approach to this topic, which involves studying the topic from a variety of perspectives and combining theoretical and practical knowledge (Khelashvili 2020). Using this approach, it is possible to bridge the information gap between different academic fields as well as between academia and real-life experience (Hadorn, et al. 2008, 3).

Within the scope of this research, we have narrowed down the tourism value chain to the level of the accommodation value chain.

The study covered 3 parts: 1. In-depth interviews with experts; 2. Survey of accommodation facilities through a quantitative structural questionnaire; 3. Analysis of statistical data - export-import analysis of product groups involved in the value chain of tourism in Georgia. The first two parts were implemented in 2020-2021, and the third part in 2022.

A purposive sampling method was used for in-depth interviews with experts; The main purpose of the interviews was to find out: what the share of Georgian products in the total products purchased by the accommodations and how this situation has changed in the last years; and if Georgian products meet their standards in terms of quality, competitive price, quantity, stability and safety standards.

The survey of accommodation was mainly used for identifying the main product groups involved in the accommodation value chain and again finding out the share of Georgian products in each group.

To verify and validate the survey’s and in-depth interviews’ results, information about the import and export of the main products involved in the accommodation value chain was requested from the National Statistics Office of Georgia. HS4 code was used for products and more than 20 000 inputs were analysed.

A total of 5 in-depth interviews with experts were conducted and 41 representatives of accommodations were interviewed. In-depth interviews mainly tell about the experiences of Tbilisi Marriott, Courtyard Marriott, Hotel Borjomi-Likani, guest houses and small hotels. The surveyed accommodations differ in scale, geographical location and date of establishment.

As a result of empirical studies, 22 large groups of products, that are required for the functioning of accommodations, have been identified.

To see the complete picture, we studied the export-import balance of the products included in the mentioned product groups and their geographical distribution. It is difficult to determine what part of the exported or imported products traded in the territory of Georgia come from accommodations, but the analysis of these data is an excellent way to determine the general trend. By observing these data, it is clear which group of products is dependent on imports and also which countries and regions.

Excel, QGIS and MAXQDA were used for data processing and analysis.

Results and discussion

Hotels' attitudes and behaviours towards products differ between international brands and local brands, according to in-depth interviews. In the case of Marriott hotels, for example, quality and suitability with brand standards are the first criteria, followed by price-quality ratios. Their criteria do not take into account the country of origin factor of the product. The procurement system is automated with software that selects the most cost-effective options. They don't have any loyalty to Georgian products just because they're Georgian.

However, the priority for Hotel Borjomi-Likani (a large local hotel) is to buy as many Georgian products as possible, of course, while maintaining quality and safety standards. Then comes the price impact. According to a respondent, in general, Georgian products are more expensive than imported ones, but they still choose Georgians. In some cases, price-related priorities are stronger than those related to national production.

Despite the difficulties, according to experts, over the past five years, the share of Georgian products in the tourism value chain has increased significantly, which is due to several factors: relatively stable Georgian suppliers appeared on the market; a distribution network linking small farmers and peasants and accommodations has been improved (Sharia 2022, 145-146).

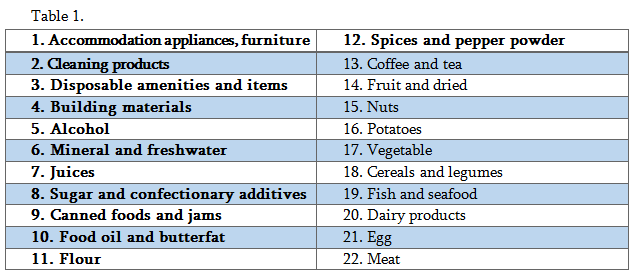

As a result of a structured survey and then based on interviews with experts, 22 main product groups included in the value chain of accommodations were identified (see Table 1).

Main Product Groups Involved in the Accommodation Value Chain of Georgia

Accommodation appliances, and furniture – are imported from 51 countries and exported to 38 countries. In this regard, Georgia’s trade balance is negative at -129,429.07 thousand. U.S. dollar.

• Cleaning products - are imported from 45 countries and exported to 20 countries. The trade balance is negative at -44643.63 thousand. U.S. dollar.

• Disposable amenities and items - are imported from 45 countries and exported to 26 countries. The trade balance is negative at -91759.91 thousand. U.S. dollar.

• Building materials - are imported from 49 countries and exported to 35 countries. The trade balance is negative at -367016.12 thousand. U.S. dollar.

• Alcohol - is imported from 35 countries and exported to 50 countries. The trade balance is positive at 316768.44 thousand. U.S. dollar.

• Mineral and freshwater – are imported from 30 countries and exported to 38 countries. The trade balance is positive at 179134.15 thousand. U.S. dollar.

• Juices - are imported from 22 countries and exported to 25 countries. The trade balance is positive at 5573.85 thousand. U.S. dollar.

• Sugar and confectionary additives - are imported from 39 countries and exported to 15 countries. The trade balance is negative at -110161.37 thousand. U.S. dollar.

• Canned foods and jams - are imported from 28 countries and exported to 20 countries. The trade balance is negative at -14421.36 thousand. U.S. dollar.

• Food oil and butterfat - are imported from 26 countries and exported to 13 countries. The trade balance is negative at -78981.25 thousand. U.S. dollar.

• Flour - is imported from 18 countries and exported to 22 countries. The trade balance is negative at -9336.07 thousand. U.S. dollar.

• Spices and pepper powder – are imported from 25 countries and exported to 32 countries. The trade balance is positive at 6346.97 thousand. U.S. dollar.

• Coffee and tea - are imported from 32 countries and exported to 22 countries. The trade balance is negative at -23260.39 thousand. U.S. dollar.

• Fruit and dried - are imported from 25 countries and exported to 28 countries. The trade balance is positive at 73080.86 thousand. U.S. dollar.

• Nuts - are imported from 24 countries and exported to 37 countries. The trade balance is positive at 96288.95 thousand. U.S. dollar.

• Potatoes - are imported from 8 countries and exported to 11 countries. The trade balance is positive at 14276.95 thousand. U.S. dollar.

• Vegetable - is imported from 16 countries and exported to 15 countries. The trade balance is negative at -14329.51 thousand. U.S. dollar.

• Cereals and legumes – are imported from 33 countries and exported to 9 countries. The trade balance is negative at -129217.01 thousand. U.S. dollar.

• Fish and seafood - are imported from 32 countries and exported to 5 countries. The trade balance is negative at -27207.13 thousand. U.S. dollar.

• Dairy products - are imported from 32 countries and exported to 5 countries. The trade balance is negative at -63415.6 thousand. U.S. dollar.

• Egg – is imported from 32 countries and exported to 5 countries. The trade balance is positive at 8.67 thousand. U.S. dollar.

• Meat - is imported from 34 countries and exported to 7 countries. The trade balance is negative at -57186 thousand. U.S. dollar.

The overall balance of these 22 product groups is negative at -468886 thousand. U.S. dollar. Only 8 groups have a positive trade balance, these product groups are alcohols, mineral and freshwater, juices, spices and pepper powder, fruit and dried, nuts, potatoes, and eggs.

The product group with the largest negative trade balance is building materials. For this type of product, the top 10 importer countries are Turkey, Azerbaijan, Russia, Ukraine, Italy, Germany, Poland, Belarus, Czechia, and Armenia.

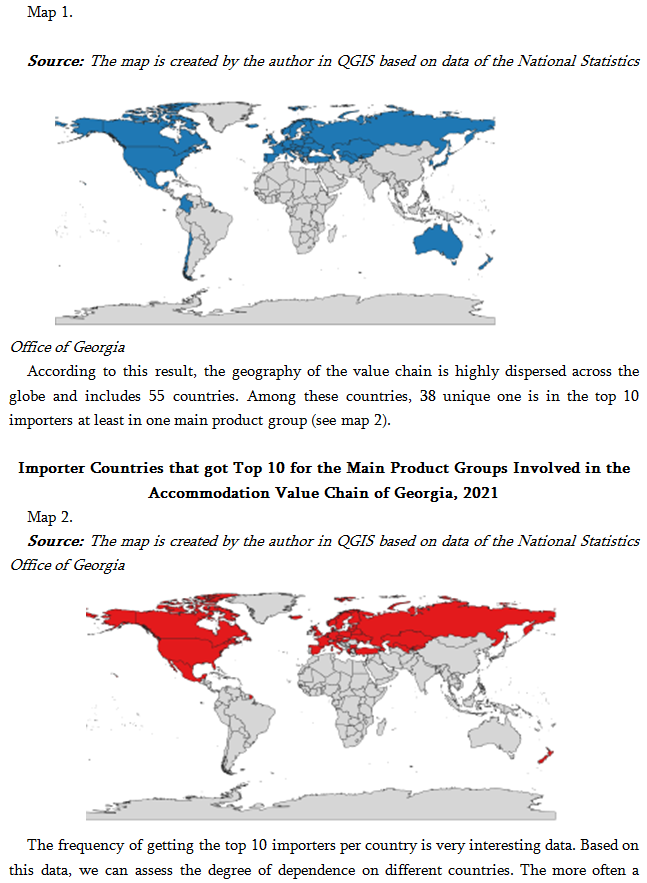

The overall geographical distribution of the accommodation value chain is shown on map 1.

Importer Countries for the Main Product Groups Involved in the Accommodation

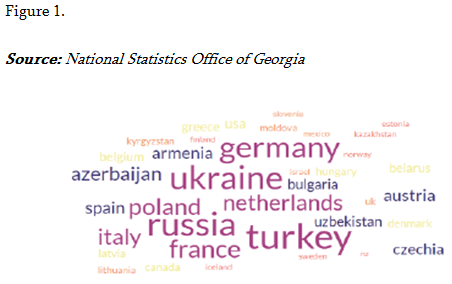

country is repeated in the group of top countries, the more Georgia's tourism depends on it. According to the word could (see figure 1), the leading players are clearly visible, they are Turkey, Russia, Ukraine, Germany, and France. Two leading players Ukraine and Russia are at war with each other.

Frequency of getting into the top 10 importer countries, 2021

The significantly diversified geography of the value chain means that a large part of the income received from tourism flows outside of the country, which does not indicate the sustainable development of Georgia’s economy.

The given statistical information is supplemented by empirical studies, which help us to perceive the situation in a more complex way. For example, the dairy products group has a real chance to be more involved in the tourism value chain. According to the respondents, currently, local dairy products are not suitable for making some products, for example, coffee and confectionery. Therefore, accommodations have to purchase imported ones mainly from Ukraine. If the local manufacturers know the market requirements and standards and adjust their products accordingly, they will be more included in the tourism value chain and increase their business. This principle is applicable to other groups of food products as well.

As can be seen from the list of main products involved in the accommodation value chain, only four of them are not from the food industry. Not all types of accommodation offer tourists a wide range of services, delicious meals, drinks, and snacks, but all of them use these four main product groups: accommodation appliances, furniture, cleaning products, disposable amenities and items and building materials. Empirical studies have shown that the share of Georgian products was the lowest among these four product groups (Sharia 2022, 143). In the opinion of the experts interviewed, the Georgian market is small for the production of these products, and the initial capital expenditures for developing appropriate industries are high. At the same time, in today's highly competitive international market, focusing on exports is a major challenge. Therefore, investors are not interested in investing in such businesses in Georgia.

This article reveals current situations that will be a good basis for future research. Each product group and the potential in the country for the development of their production are to be studied in depth from different field positions. In order to plan the tourism industry as well as the value chain of tourism optimally, it is necessary to analyze in what fields we will have a competitive advantage.

Conclusion

Scientists agree that tourism has the opportunity to contribute to the development of other branches of the country's economy. However, developing countries face difficulty taking advantage of this opportunity, since their economies are less diversified, and imports represent a large portion of their consumer spending. Georgia is not an exception.

To assess the real impact of tourism, it is important to study the tourism value chain and the links between tourism and other sectors of the economy.

As an import-dependent country, the tourism value chain of Georgia is quite diversified and dispersed geographically. To meet the needs of tourists, most of the products used by accommodations have a negative trade balance, which means that the products needed by the tourism industry are imported. Therefore, instead of the tourism industry stimulating various branches of the economy within the state, the money remaining completely in the country and investing in various activities, a large part of the money received through tourism goes out of Georgia and is used in the economy of the importing countries.

In addition to being unable to contribute to the development of the local economy, tourism itself is unstable due to its dependence on imports and other countries because the socio-political and economic situation in the importing countries can affect the tourism industry in Georgia. The list of top 10 importing countries is also noteworthy, out of which, two are involved in the war. Of course, the specifics of the development of the field are affected not only by geography but also by geopolitics.

However, compared to previous years, the situation is changing for the better and the prospects in several fields are becoming clearer, for example, the wine industry, agriculture, and food industry. Accommodation representatives note positive changes in the Georgian market. But it is not enough, in any case, it is necessary to ensure the competitiveness of Georgian products in terms of both quality and price. For this, it is necessary to strengthen Georgian production with modern technologies, knowledge, and qualified human resources.

References:

• Baidoo Francis and Pan, Lei and Fiador, Lassey V. O., Agbloyo & Komla E. (2022). Importing to Feed International Tourists: Growth Implications for Islands across the Globe. Munich Personal RePEc Archive. Retrieved from https://mpra.ub.uni-muenchen.de/111964/

• Hardon G. H., Hoffmann-Riem H., Biber-Klemm S., Grossenbacher-Mansuy W., Joye D., Pohl C., . . . Zemp E. (2008). Handbook of Transdisciplinary Research. Springer.

• Khelashvili I. (2018). Social and Economic Challenges of Sustainable Tourism Development in Georgia. III International Scientific Conference, Challenges of Globalization in Economics and Business (pp. 504-508). Tbilisi: Ivane Javakhishvili Tbilisi State University. Retrieved from https://tsu.ge/data/file_db/economist_faculty/konference.pdf

• Khelashvili I. (2020). The Concept of Tourism and Sustainable Development. Tourism Sustainable Development.

• Papava V. (2018,). Rondeli Blog: Georgian Foundation for Strategic and International Studies. Retrieved 11 20, 2022, from Georgian Foundation for Strategic and International Studies: https://gfsis.org.ge/blog/view/854

• Rodrigues J. G., & Villasante S. (2016). Disentangling Seafood Value Chains: Tourism and the Local Market Driving Small-scale Fisheries. Marine Policy, 33-42. https://www.sciencedirect.com/science/article/abs/pii/S0308597X16300446?via%3Dihub

• Salukvadze G., & Backhaus N. (2020). Is Tourism the Beginning or the End? Livelihoods of Georgian Mountain People at Stake. Mountain Research and Development. https://bioone.org/journals/mountain-research-and-development/volume-40/issue-1/MRD-JOURNAL-D-19-00078.1/Is-Tourism-the-Beginning-or-the-End-Livelihoods-of-Georgian/10.1659/MRD-JOURNAL-D-19-00078.1.full

• Salukvadze G., Gugushvili T., & Salukvadze J. (2019). Spatial Peculiarities of Local Tourism Supply Chains in High-Mountainous Georgia: Challenges and Perspectives. Journal of Geography Volume 10, Number 3, 173-188.

• Sharia M. (2022). Share of Georgian Production in the Value Chain of Georgia Tourism. ISCONTOUR 2022 Tourism Research Perspectives. .Innsbruck/Krems: Herstellung und Verlad: BoD – Books on Demand, Norderstedt.

• Vanriel W. (2013, March 14-15). YUMPU: document. YUMPU: https://www.yumpu.com/en/document/view/22366842/strategies-to-develop-effective-linkages-between-tourism-unctad

• Wondirad,A., Kebete,Y., & Li Y. (2021). Culinary Tourism as a Driver of Regional Economic Development and Socio-Cultural Revitalization: Evidence from Amhara National Regional State, Ethiopia. Journal of Destination Marketing & Management. https://www.sciencedirect.com/science/article/abs/pii/S2212571X20301049?via%3Dihub

• Geostat.ge